What is Momentum Investing Strategy?

A simple and powerful idea that can help you beat market returns

You must have heard the conventional wisdom adage - “buy low, sell high”. But there is another investment approach which is completely opposite of this, very simple yet very powerful - that’s momentum investing.

Taking a break from releasing chapters of the book, I thought of writing about this less know powerful idea about investing. If you are new to this idea, it will probably blow your mind 🤯 . Read on!

What is momentum investing?

The key idea behind momentum investing approach is to buy when the price is rising and sell when it’s falling. It’s an approach where you ride the “trend” in the price.

Note that what you are doing here is “Buy High, Sell Low” and is opposite of the popular advice of “Buy Low, Sell High”.

And this strategy can be applied for everything - from short term trades that last seconds to long term investments that last decades. This can be applied for anything where you have regular prices available - stocks, crypto, commodities etc

This approach is very popular in trading. A big majority of successful traders are trend followers at the core. In the world of long term “investing”, momentum as a concept is gaining in popularity.

Why momentum investing works?

Let’s assume you are in 2007. You are convinced that mobile phone is going to be a huge market in coming years and are looking to invest in companies that will be winners in this market. You have to decide between Nokia, Blackberry, Apple (iPhone was launched recently). At that time very few people could have guessed how iPhone would dominate in coming decade and complete decimate the competitors like Nokia and Blackberry. But if you had been a momentum investor, you would have exited your positions in Nokia and Blackberry at a small loss when its stock price decline would have begun. At the same time you would have made a killing in Apple’s shares by staying invested for the entire decade and not selling too early. This is how momentum investing works.

There are many areas where you just can’t predict the future (like Bitcoin). But you can be sure of one thing - if something is becoming successful, its price will be in an uptrend; if it’s failing, the price will be in a downtrend. The price is an “intelligent” signal. It’s the net sum of all the forces acting on an investment. Momentum investing is a recognition of this intelligence in prices.

Another reason why momentum investing works is because it prevents you from taking emotional decisions. With momentum investing, you will have clear entry and exit points based on the strategy being followed, and your ‘opinion’ has no role. This non-discretionary nature makes momentum investing a disciplined approach.

How to do momentum investing?

Any momentum strategy consists of following ingredients - 1) Trend Indicator, 2) Entry Criteria and 3) Exit Criteria. There are 100s of trend indicators that you can choose from or create your own. Basis that, you can define your rules for entry and exit criteria. Some examples from table below will give you a drift of how this works -

Is momentum investing risky?

This is a common myth. Momentum investing is not really more risky than other investment strategies. The risk level depends on the kind of individual stocks that are part of the portfolio.

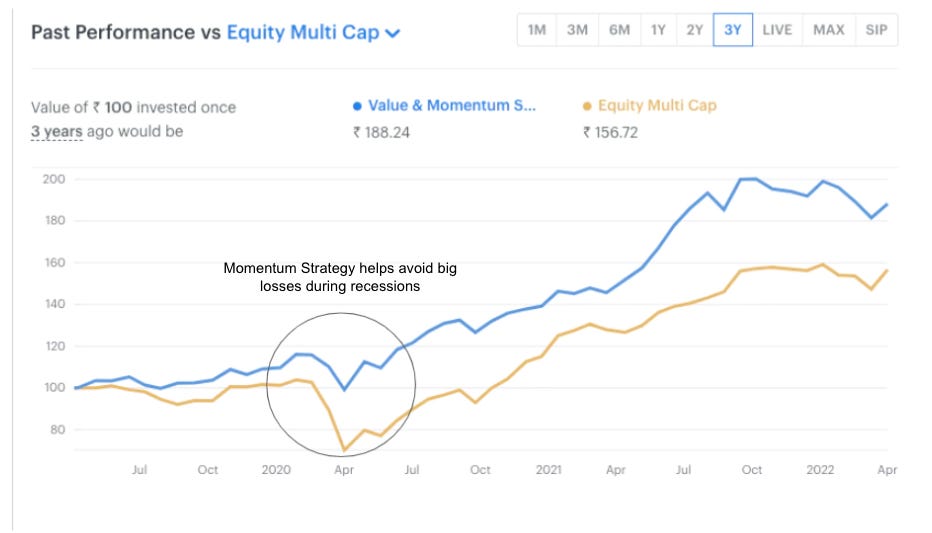

Momentum Investing has one positive thing in terms of riskiness. It protects you from big losses. For example, if you are investing money in stocks and are afraid of losing money in a 2007-like recession, momentum investing will help. You will exit with a small loss when the eventual recession finally comes. This chart below shows how momentum investing saved me from a big drop during the Covid outbreak crash of early 2020. The markets tanked 40% while I got out with a 15% loss.

What’s the downside to momentum investing? What’s the catch?

Many people think of investing like a no-brainer silver bullet. It seems like an easy way to make money, so why everybody is not doing it already?

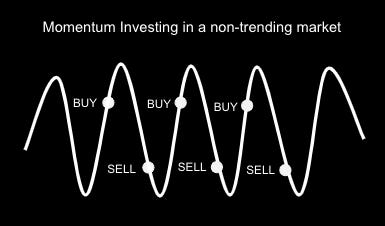

Because like everything in life, momentum investing also comes with a catch. The momentum strategy works well when the markets are in a trend - either uptrend or downtrend. But it leads to losses when the market is moving side ways in a range. The momentum strategy will end up taking a lot of small losses unlike a simple buy and hold strategy.

This is one of the reasons why my investment strategy is a mix of 50% momentum and 50% value (consisting of undervalued companies). This helps to position the portfolio for consistent outperformance irrespective for market conditions. You can follow this investment strategy through my Value and Momentum smallcase here.

Hope you got a flavour of how momentum investing works. It’s a perfect strategy to employ when you don’t have the time or resources to do research on an investment. It will help you avoid averaging down on dying companies and making big losses. At the same time, it will ensure that you gain the most out of your winners by not selling too early.

If you are trading in Bitcoin or other Cryptos, I wouldn’t suggest holding on for dear life (“HODLing”). Better to employ a long-term momentum strategy. That way - you will make money if Bitcoin is really going to the moon, and get out early if its going to zero.

Also, many investing legends have employed momentum investing in some form. Check out this short 1 minute video from Rakesh Jhunjhunwala about his trading style. Its a good crash course about momentum investing.