[Mindset change #4] - Always compare returns with a benchmark

The best kept secret of the finance industry

Person A - "My large-cap mutual fund has given me 80% returns over the last 5 years. What else can I ask for, the performance is just amazing!!!"

Person B - "You can ask for more, because the performance is not really amazing, its actually quite bad"

Person A - "Wait -What???"

Person B - "You see the broader market index has returned 96% in the last 5 years. In comparison, your large cap mutual fund with 80% gain has underperformed by 16%. You could have put the money in an index fund and got that 96% return without paying any fee."

Person A - “I care only about the returns I made. Why should I compare? Should I really care about performance v/s market index?”

Person B - “If you ask me, returns v/s benchmark is all you should care about. Else you are just throwing darts in the dark”

Investing feels like politics - a fuzzy and vague topic where you can’t be sure what’s right and what’s wrong. Half of that fuzziness will go away if you learn to view returns by comparing with a benchmark. It’s the single most important mindset shift you should embrace to demystify investing!

Adopt this mindset so strongly, that people will think you are crazy

If your portfolio is up 20%, but the benchmark index is up 30% - you should be unhappy. If your portfolio is down 20% but the benchmark index is down 30%, you should be jumping with joy. People will think you are crazy - sad when the portfolio is up, happy when portfolio it’s down. It’s fine, think of this perception of being crazy as a sign that you are on the right track.

Talking about absolute returns should be a crime

So many people talk about returns without comparing with benchmark - it really boggles my mind. If I were the leader of the country, I would make it a crime to talk about absolute returns (without benchmark) - but since I can’t do that - I can at-least educate my readers about the perils of just looking at absolute returns. There are very good reasons why you should compare returns with benchmark. So here goes my list -

Reason #1 - It’s the only way to separate skill from luck

Most of the investments are very tightly correlated with the markets they operate in. This is one of those facts that is as clear as day but not many people know about it. So if your investment went up by x%, there is a high chance that the overall market in that investment category also gave similar returns.

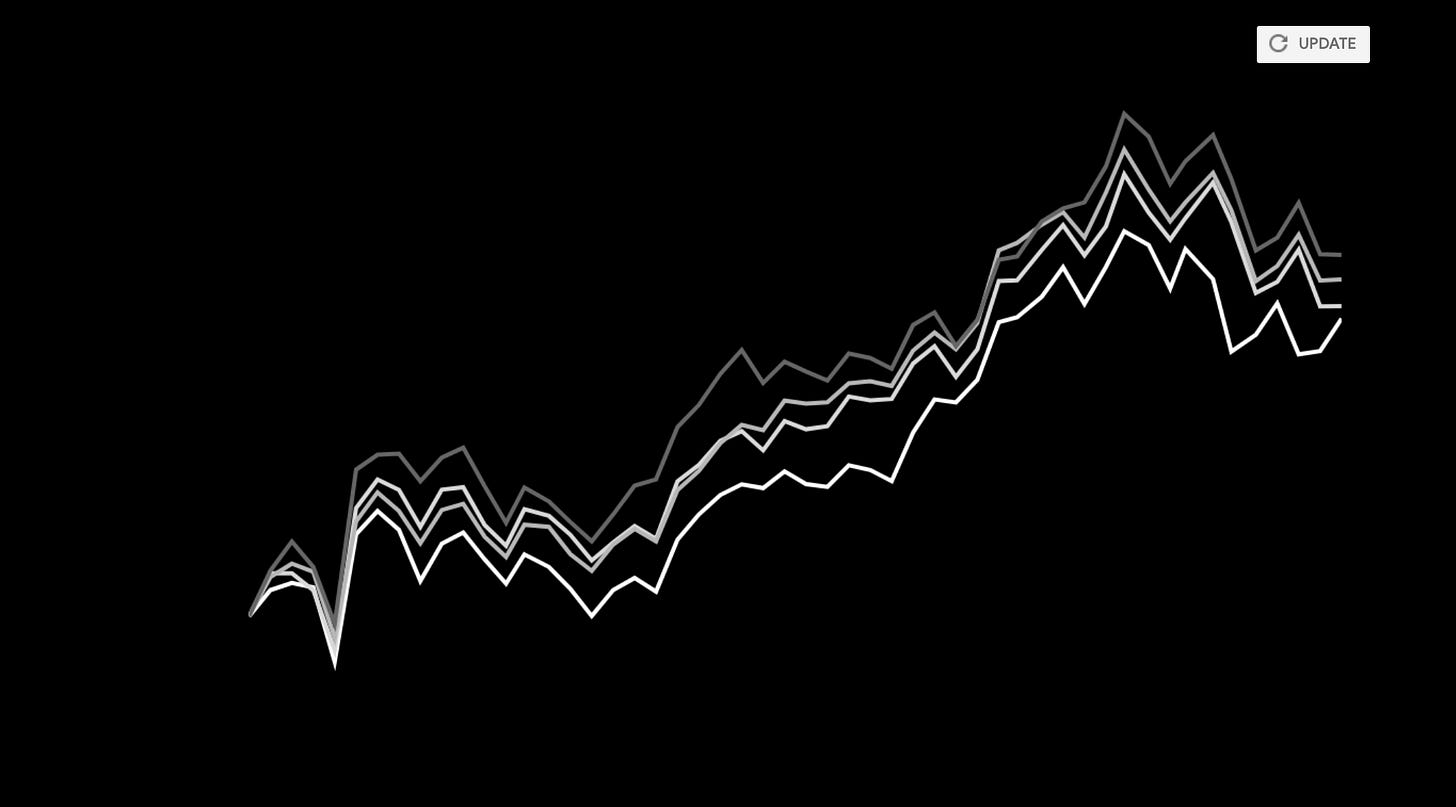

Let me put across my point with an example. What you are seeing in the image below is the investment performance of following four things for the year 2021 -

One of the lines is for Nifty 50 Index (the benchmark for broader market performance in India)

The other three lines are for some of the popular large cap mutual funds

You can see all the three mutual funds gave largely similar returns and the performance is indistinguishable from the benchmark. So if someone tells you that your mutual fund is doing well without quoting the benchmark return - it is gross injustice in my opinion.

Reason #2 - Helps compare investments across time periods

Sometimes people also get confused when the same investment gives different returns for different people. For example in the image below, if someone invested at point A - he would have made a lesser return than someone who invested at point B. Comparing with benchmark returns from similar time period helps with avoiding such confusions.

I know it seems like a very obvious point - but you will be surprised how even the smartest folks make such mistakes and live in random FOMO (fear of missing out) because of being ill informed.

Reason #3 - Helps compare investments with different risk profiles

Suppose a debt mutual fund manager got you 10% return in 2021 whereas a small cap equity mutual fund manager got you 30% return. Who is the better fund manager?

If you are talking about returns for the year 2021 - then the debt mutual fund was the better performer. Just looking at absolute returns will build up FOMO and push you towards riskier behaviour.

Reason #4 - Benchmark returns are available for free

This is the biggest reason of them all. There are two types of investment strategies you can follow - active and passive.

In active investing, you pay some fee (typically 1%-2%) to an investment manager to invest on your behalf. Whereas in passive investing, you directly invest in all the stocks in the broader market index (like Nifty 50) and pay very low fee (~0.1%). So the only way for an active investment manager to justify her existence (and fees) is to provide returns that are higher than benchmark - that too after deducting the higher fee.

So if you are judging an investment manager’s performance, you have to do it against a benchmark. It’s the only way to understand who is an expert and who is a dart throwing monkey.

Everything has a benchmark - everything!

A benchmark exists for any kind of investment asset class - be it equity, debt, real estate, commodities, hedge funds, private equity, VC etc. - everything. Within equity - you will have benchmarks for different styles - large cap, small cap, healthcare sector, banking sector etc. Similarly, within debt you will have benchmark for different styles - low credit risk, high credit risk, short term, long-term etc. In fact, regulations mandate all investment managers to select a benchmark against which investors should assess their performance.

The point I am making is that everything has a benchmark. In case your investment manager is not reporting performance v/s benchmark, then look it up or ask for it.

Get better in your quest for finding good investment managers

In my previous chapter, I had highlighted that your objective should be to find competent and ethical investment managers and stick with them for the long term. Comparing returns with a benchmark will be your first step on that path. It will give you a yardstick against which to assess competence of the managers.

Also, look for managers who are forthcoming in reporting their performance v/s benchmark - especially during times when they are under-performing. It will be a good rule of thumb to assess integrity. Also - be wary of managers who promise to achieve a specific % return for you.

If you have been investing yourself or via mutual fund, check your performance v/s benchmark now. Reach out to me if you need help there. Outperformance is your north star, adopt this mindset so strongly that people will think you are crazy.