[Mindset Change #2] - Beat the inertia, get started

Chapter #2 from my book - Rabbit Hole Guide to Investing in India

"Nothing happens until something moves" - Albert Einstein

Many people have internalised a positive outlook and made up their minds about investing. However, when it comes to the task of actually investing the money - they often delay it. Some people are stuck in a loop of inaction for years, even decades. This delay leads to financial loss (opportunity cost) and mental stress.

Maybe if you assess yourself, you may find you are guilty of such inaction as well. But worry not, you are not alone - many people have this problem. It’s such a big problem that Indian Government is willing to forgo taxes on any investments that you make under 80c. It’s such a big problem that many people are happy to take services of investment advisors or mutual fund distributors so that they don’t get stuck in such inaction. It’s such a big problem that VCs are betting a lot of money on fintech companies that are simplifying onboarding processes to beat this inertia. So while the forces of capitalism will conspire to shake you out of this inaction, I want you to take the matter in your own hands.

The key mindset change I want you to embrace is to have a 'bias for action' when it comes to starting with investing. You want to invest? - just do it! Start small if you want to, but do it! Over time, you will get the hang of it and then there will be no stopping you.

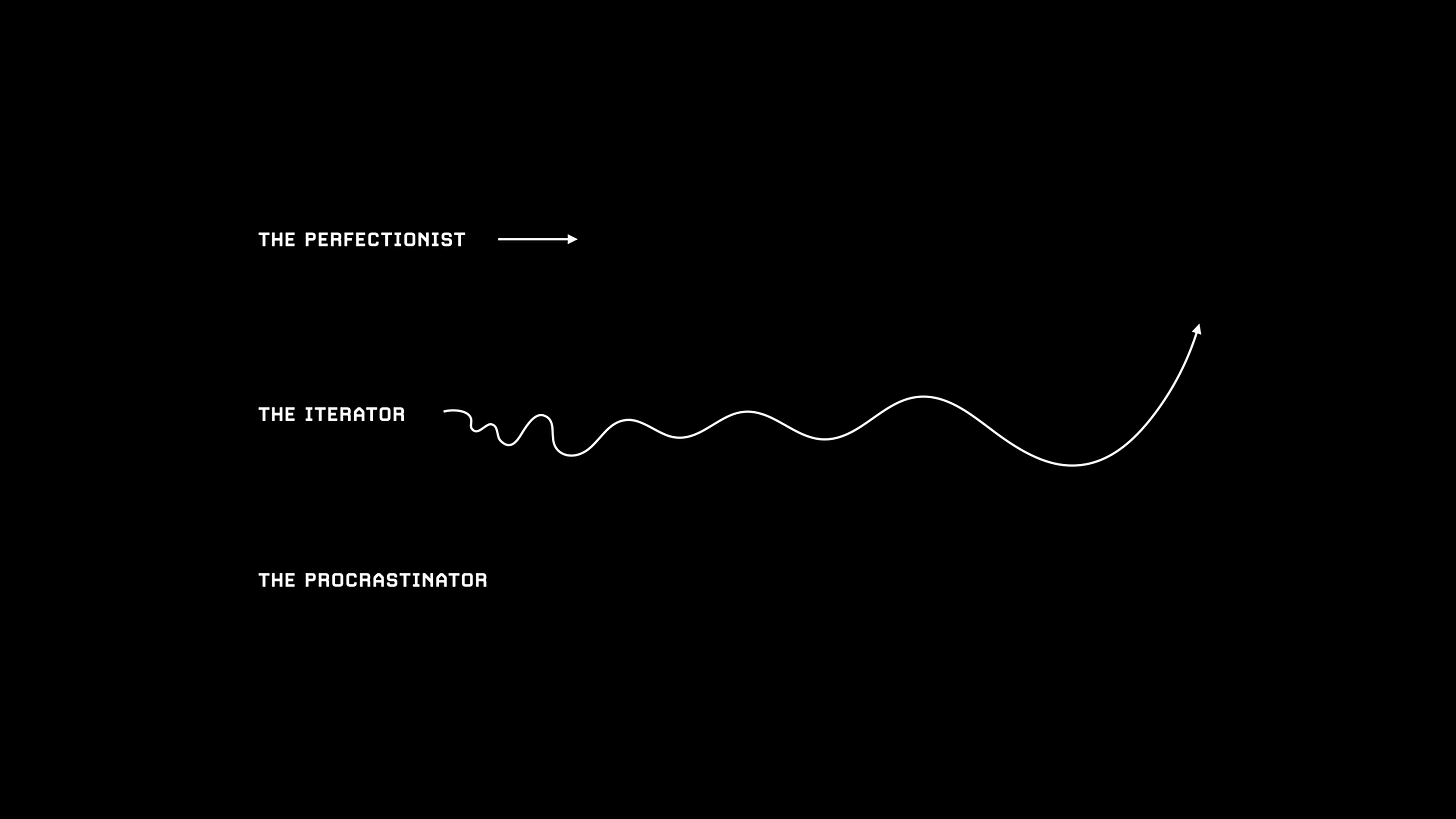

Be the Iterator - not the Perfectionist, not the Procrastinator.

In the last decade, with the advent of start-ups, lots of new ideas have taken hold. One such idea is that - “Taking lots of imperfect decisions and improving later, is better than waiting a long time for a perfect decision or taking no decision at all”. People who embody this bias for action are caller iterators or tinkerers or experimenters.

Let me tell you an example of a friend. I met him five years ago - at that time he had just left his job where he was working for a startup that was a second-hand car marketplace. He wanted to start a new venture and was thinking of ideas. He had developed a super-power of iterating and experimenting with new ideas. He was considering ideas in domains totally unrelated to his areas of expertise - healthcare and news media. I introduced him to some friends who had worked in news media before - who advised him to totally avoid this industry. But this guy doesn’t take perfect decisions - he likes to iterate with imperfect decisions and work towards his goal. Just this month, I saw in the news that he raised $12mn for his start-up that’s in the hyper-local news media space for non-English speakers. He landed on a totally unconventional and valuable idea by iterating.

When I think of it, investing is no different. Many of us are stuck in the cycle of inaction due to procrastination or aiming for perfection - instead I want you to become iterators. Want to invest in a mutual fund, smallcase, gold, investment trust, mamaji’s stock tips? - just do it, if you think it’s promising.

If you are the procrastinator type - I empathise with you. Me and my wife have been delaying the process of opening her Zerodha account for 3 years now. You could be very active and diligent usually but put things off when it comes to investing. Maybe because you find the process of investing boring - like filing taxes. Maybe because you got stuck somewhere due to technical error (like OTP not coming). Happens with everyone, don’t worry. Think of it like ripping off a band-aid and just do it. Once you do it the first time, it will become very easy thereafter. And remember to embrace technology and take advantage of features like auto-SIPs to minimize inertia (more on this later).

Also, if you don’t have the time or inclination to invest by yourself, hire the services of any competent investment advisor. It will be worth it.

If you are the perfectionist type - have comfort in the fact that nobody gets it right the first time. You will learn by making mistakes. In the later chapters of this book, I will tell you how you iterate and make sure you are on the right path. The good thing about investing is that it is not a big or permanent commitment like marriage. You can choose to start small and if you are not happy or find something better, you can easily get out.

The inaction and inertia towards investing is a problem - recognise it and develop a ‘bias for action’ mindset to try what you like and get started. What’s your take on this? Are you in a similar situation? I would love to know!

Thanks for the article. I would suggest writing about avoiding lot of action and virtue of patience in the investing.