Godrej Industries — Business Class Seats at Economy Price

The stocks trade at a whopping 70% discount to the value of its investee companies - and hence an attractive value pick

Dear subscriber -

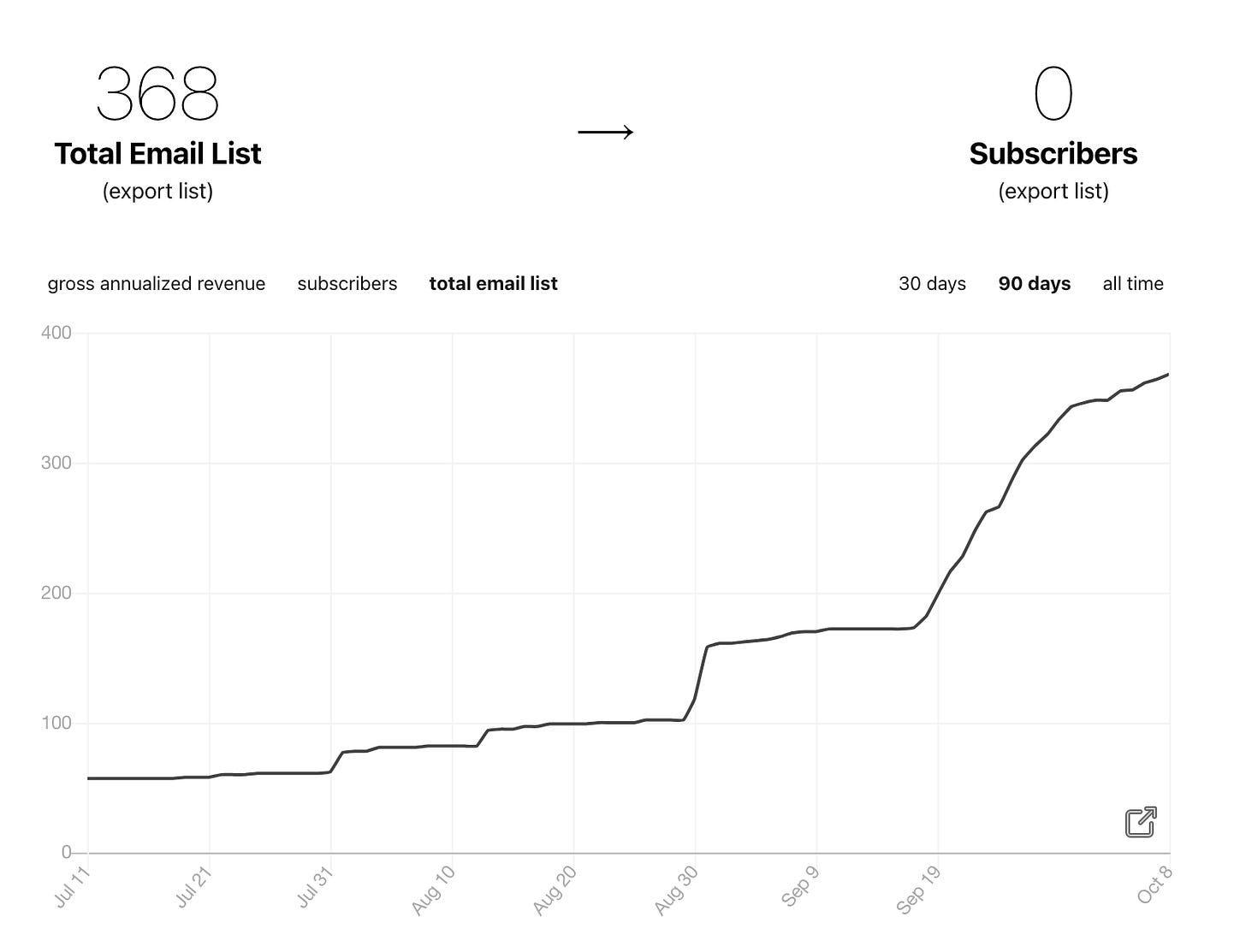

Firstly, I am happy to report that this newsletter is growing well. We have 350+ subscribers within the first few months of launch - beating my growth expectations by a wide margin. If you like the content, do share it with your friends :)

In the newsletter, I often discuss individual stock picks and the rationale behind it. The stock I discuss today is Godrej Industries. Read on — it will give you a good flavour of value investing.

Godrej Industries - What’s the business?

Godrej is a well-known brand. The group has many businesses, and it’s important to highlight what all come under the ‘Godrej Industries Ltd’ (or GIL) name. First, a disclaimer - when people hear about Godrej, they always think about almirahs, locks, furniture (Godrej Interio) and appliances like refrigerators and washing machines. These businesses are not part of GIL. They are in a separate company which is privately held.

GIL is a holding company (more on it later) that has stakes in other companies of the Godrej group. The chart below gives a good explanation.

Godrej Consumer Products is a company that owns many of well known FMCG brands that we use. The snapshot below shows some of the top products. This is an excellent company with a strong presence in markets outside India and a DNA of constant innovation through new products. It’s also part of the smallcase portfolio as a momentum pick.

Godrej Properties is a real estate developer with properties in all major cities of India. If you have ever done house hunting – you would have indeed come across names of some of the Godrej properties in your city. The company has a good brand name as a reliable developer with properties of premium and low-cost/affordable category.

Godrej Agrovet is one of the new ventures that are involved in commodity/farmer related products - including palm oil, dairy, poultry, animal feeds, crop protection and more.

The great thing is that the three businesses above are mature and listed on stock markets individually. Apart from this, Godrej also has other businesses in chemicals, finance and other domains with 100% ownership – but they are relatively small. GIL, in essence, is a holding company – that holds ownership in different companies.

What are holding companies?

A holding company’s primary business is holding stakes in the shares of other companies without essentially producing goods or services. You must have heard of Warren Buffet’s Berkshire Hathaway and Masayoshi Son’s SoftBank - these are holding companies. Similarly, many holding companies have been created in the Indian stock market over the years - some examples can be seen below. Godrej Industries is one such holding company.

The investment thesis — “Business class seat at the economy price.”

My central argument is that GIL is undervalued. Let’s go through the arguments why. Calculating the value of GIL should be fairly straightforward - take the valuation of the investee companies, multiply by % stake held by GIL and add them all together. In the table below, we did this exercise and realised that in an ideal world the value of GIL should be around Rs 64,000 crores. While a holding company always has some discounts because of different reasons (discussed below), we would have expected the traded value of GIL to be close to Rs 50,000 crores.

However, you will be surprised to know that the stock trades at 19,000 crores only — a whopping 70% discount to its value or in other words, the “valuation ratio” (GIL’s market cap/holding companies value), is just 30%. This is why GIL is a way to get business class seats at an economy price. The great thing is that I also like the underlying businesses. We even have Godrej Consumer in the smallcase portfolio as a momentum pick.

This 30% valuation ratio is a compelling enough reason to buy the stock, but we will briefly dig deeper.

Digging Deeper

There are legit reasons for a holding company to trade at a discount. The top ones being double taxation, conglomerate discount, presence of cash guzzling businesses that require capital and trustworthiness of the management. Some of these reasons are applicable for GIL, and some are not - I will spare you the details. The important point is that I don’t expect GIL to rise 3x till the discount becomes zero.

Some discounts will always be there, and looking at how this discount has trended over time will give us some clues. The chart below has data on GIL’s valuation ratio over the past decade. We can see that in the past, it has stated a valuation ratio of 60%, whereas the current ratio of 30% is half of that. So the discount is wide even when considering recent history.

One of the reasons why the valuation ratio has decreased is because GIL entered into the retail business through Godrej Natures Basket — a gourmet retail chain selling high-end grocery items. This became a cash guzzling business that did not become successful. However, now the company has sold off that business and this should help improve the valuation ratio.

Last year even the owners of GIL — the Godrej — felt that the stock was super cheap and bought some shares in the market to increase their stake. This serves as a vote of confidence that even the company owners find the stock to be cheap.

The key risk is if we see the value of the underlying holding companies decline too much — or if GIL starts investing in some business that becomes a money guzzler.

The Implication

GIL first entered Simple Investing’s portfolio early last year and has given 2X returns (performing slightly better than the market). We like the underlying holding companies and the discount that investing via GIL offers.

Please don’t treat this as investment advice. Consult your financial advisor for making any investment decisions. The idea behind writing this article was to give you a flavour of how we at Simple Investing take value investing focused investment decisions even when the overall market looks expensive.

If you have any questions about GIL and investing in general, please feel free to reach out to me or post your thoughts in the comments section. I will try my best to answer.

If you like my approach and want to follow my investment strategies, do subscribe to my smallcase.